It is tax season, And i believe most of you want to learn the latest taxpayer tax refund method in2025. So, I will guide you through all the necessary questions to prepare so you can get a return between $2,000 and $91,000. Are you ready? Let’s get started.

Requirement

To file our refundcorrectly, we need to meet the following demand, which is:

https://www.cardingshop.club/product-category/ssn-dob-other-docs/

- Social Security Number (SSN)

- Identification Card Number and All necessary info

- Current Address

- Void Number (It will best to have your drop Number)

- Create a separate email with the SSN Info.

- Extract the Identity PIN from your Verified ID.me

- Good IP

- Previous AGI figures

- Bank in drop name (Routing and Account Number)

How To Get Your IRS IdentityPIN From ID.ME

Once you have all theabove information ready, the next thing is to extract the identity PIN fromyour Verified ID.me along with the previous Adjusted Gross Income and todo that:

- With your Socks Connected to drop address, go to the IRS website, irs.gov, click “Sign in to Your Account”, and tap “Sign into your online account”.

- Sign in to your ID.me account and verify all the necessary 2fa. (A code will be sent to the owner; get the code and use it to confirm)

- Next, locate the Adjusted Gross Income by selecting Tax Records and click on it to see the information.

- Click on Get An Identity Protection PIN (IP PIN)

- Tap on Get an IP PIN and click Continue; your 6-digit number will be displayed.

Note: Before we begin the primary process, pleasebe informed that this method won’t work for persons over 60. If your drop isretired, don’t bother filing unless, of course, you can pay the filing fee.

How To File TaxpayerTax Refund Method 2025

1. First, go toTaxSlayer.com and click on the file for free button under the”Simply Free” or “Self-Employed“.

2. Enter your detailsto create a TaxSlayer Account.

3. They will send acode to the number you used for the account; enter it here and verify

4. Click on Continue

5. Scroll down and tapon “No Thanks, Continue with simply free”

6. Click on Skip

7. Fill in all thenecessary info here, and ensure the date is not above 60 years.

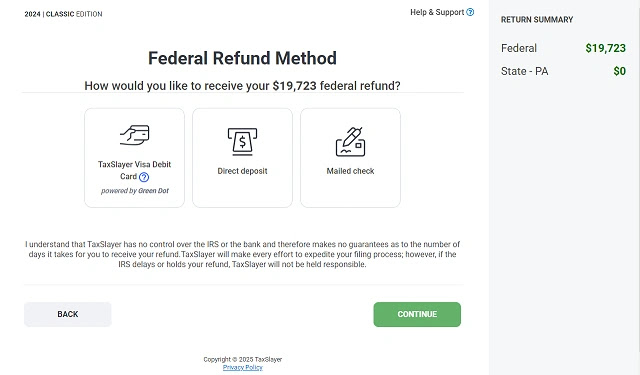

8. Enter the address,including the state

9. Residency Status:” I am a full-year resident of this state

10. Click on Skip

11. Filing Status:choose “Single.”

12. Defendant orQualifying persons: choose “No.”

13. IRS IdentityProtection Pin: Select “Yes, someone on my return received anidentification Pin.”

14. Now enter the pinhere; remember this is the pin you extracted from the id.me

15. Click on Continue.

16. Scan through andsee if everything is cool, then continue.

17. Check mark the agreement box for all the two types, the drop name, and continue.

18. Click on Continue.

19. Do the same thingon this page.

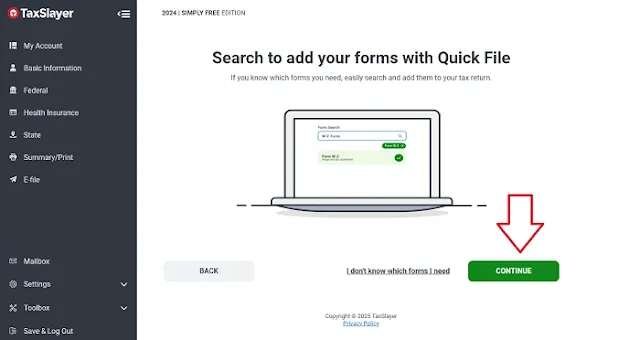

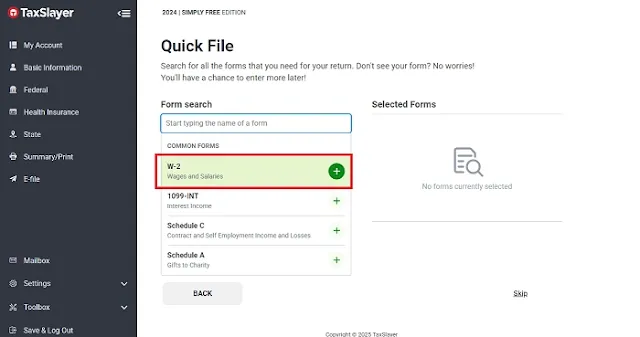

20. Now, in the searchbar, Type W-2 and click on it

21.It should be addedhere on this page, then click on Continue.

22. Click on Continue.

23. On this page, you will need to find any companies in the same state EIN by googling 100 companies in the same state. You can also go to eintaxed.com orwww.sec.gov/search-filings and put a company name to get the EIN and address here.

.webp)

25. Now, scroll to thee-section, which is Employee Info and enter the drop details.

26. In this section, enter the EIN and the address you generated from eintaxed.com or www.sec.gov/search-filings in step 23

27. Now, when you get to this very section, the figures you will put here will determine the amount you will get, and it is mostly done by using the first two boxes, which are “Wages, tips and compensation,” and “Federal income tax withheld.”

So, assuming you go with $85700.00 as your Wages, tips, and compensation,” you will need to calculate it by a percentage, and that answer will be in box line two, which is the “Federal income tax withheld.”

So I calculated 35% of 85700.00, which gave me “29995.” So, if you want a higher refund, you can increase the first box amount and the second box amount to get the amount you want as your refund.

But to get box number 4 correct, multiply 6.2% of the amount you will put in box 5.

To get box six also correct, multiply 1.45 by the amount you will put in box 5.

These six boxes are the ones in which you would want to put the correct figures to get your refund correct. Once you get the calculations wrong, forget it.

28.When done with the above, scroll down and click on continue.

29.Once you click on continue, the refund amount will be calculated and shown here. If the money is not what you are looking for, click the three-dot and tap edit, then go back to boxes 1 and 2 and do higher numbers to meet your expected refund. Box 2 should not be more than 45%.

.webp)

30. Click on Continue

.webp)

31. Continue

32. Choose No

33.Click on Skip

34. Wait till it’s finish loading

35. Scroll down and click on Continue.

Hold on for the rest, However, it’s simple and anyone can do by entering your Bank and the rest and you are done.